njtaxation.org property tax relief homestead benefit

You were a New Jersey resident. Unlike Hawaii Alabama and Colorado which are states with the lowest property taxes New Jersey has one of the highest tax rates in the country219.

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

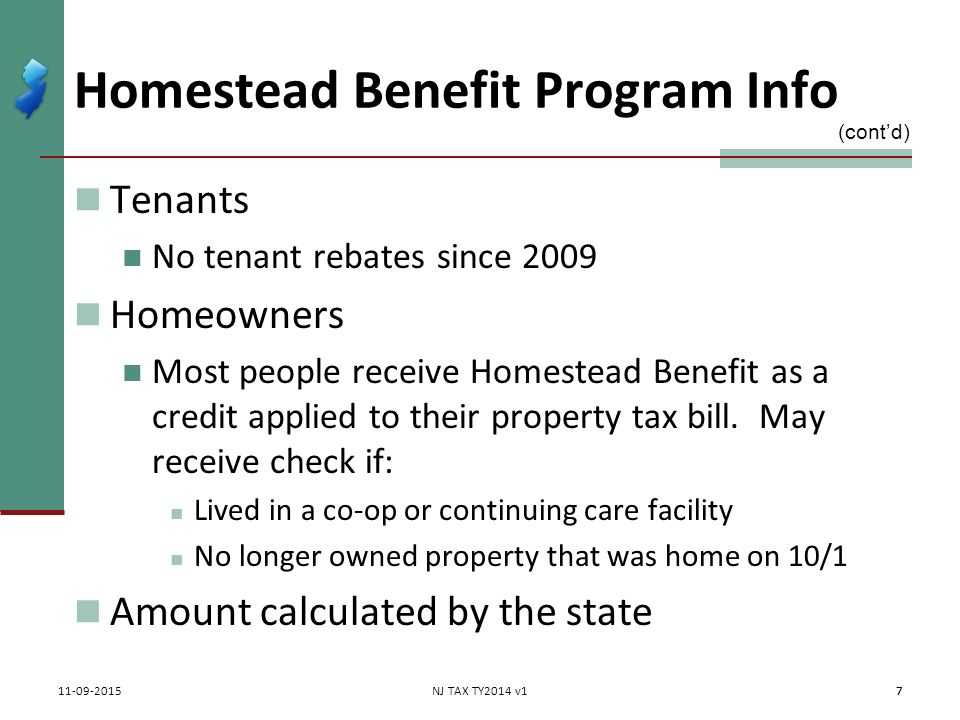

Most recipients get a credit on their tax bills.

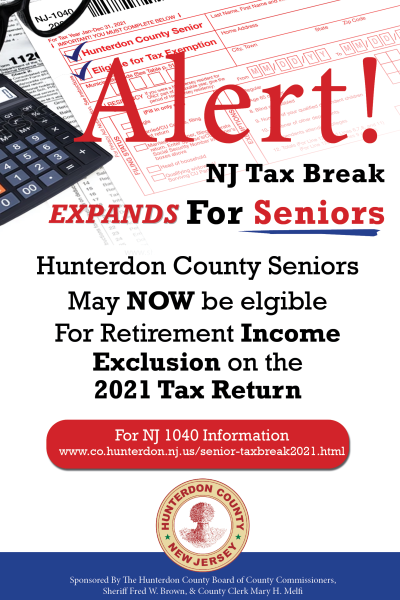

. OConnor Associates is the largest Property tax Consultant in Texas. Eligible seniors or disabled people with New Jersey gross income of up to 100000 would get a credit worth 5 of their 2006 property taxes. The 2016 income requirements were that you had to earn less than 150000 for homeowners who are age 65 or.

File for the property shown with your Identification Number. Funding for the property tax relief program. Preprinted Identification Number and PIN.

And The 2018 property taxes were paid on that home. You may not have the Adobe Reader installed or your viewing environment may not be properly. The NJ Division of Taxation mailed New Jersey homeowners filing information for the 2018 Homestead Benefit in October.

1-877-658-2972 When you complete your application you will receive a confirmation number. Homestead Benefit and Senior Freeze Property Tax Reimbursement payments are not taxable for New Jersey Income Tax purposes and should not be reported on the New Jersey Income Tax return. Ad OConnor Associates is the largest Property tax consulting firm in Texas.

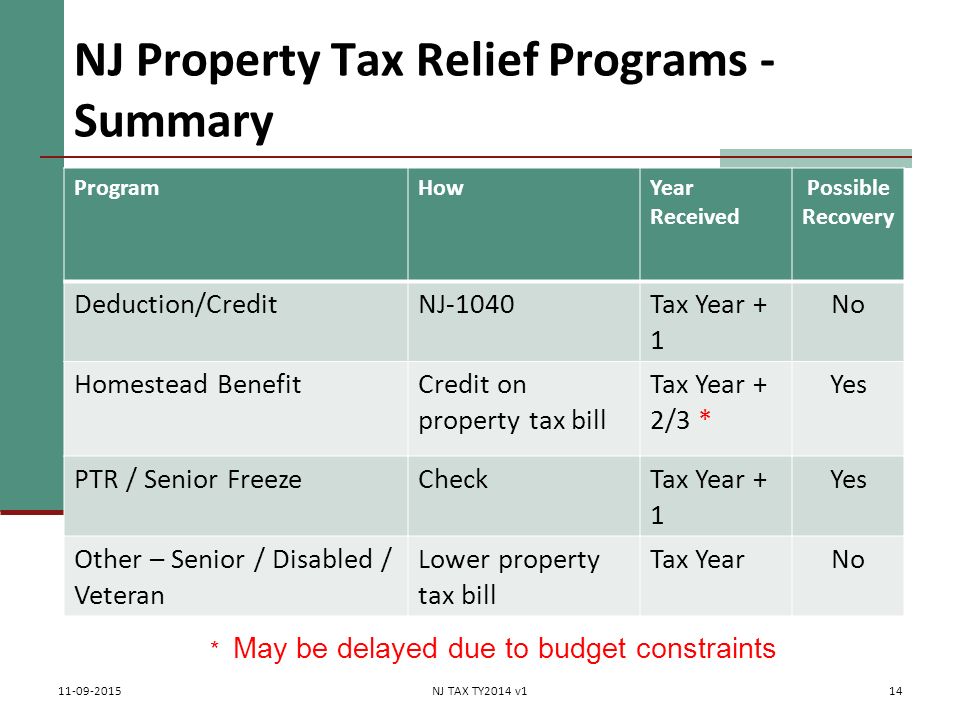

Your tax collector issues you a property tax bill or advice copy reflecting the amount of your benefit. Multiplying the amount of your 2017 property taxes paid up to 10000 by 10. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018.

Tenants The amount appropriated for property tax relief programs in the State Budget does not include funding for 2018 tenant rebates. You are eligible for a 2018 Homestead Benefit as a home-owner if. Moreover the average property-tax bill has increased by more than 40 since 2006 according to the states most recent tax data.

The benefit amount has not yet been determined. Information on the federal tax treatment of these payments called recoveries by the IRS can be found in the federal Form 1040 instructions and IRS. If you have not received filing information in the mail or an email from us check the application mailing schedule.

You can get information on the status amount of your Homestead Benefit either online or by phone. The system will also indicate whether the benefit was applied to your property tax bill or issued as a check or direct deposit to your. Your benefit payment according to the FY2022 Budget appropriation is calculated by.

Now the average Homestead Benefit is about 490 and it is calculated based on the 2006 tax year according to the state tax data. Follow the instructions You owned and occupied a home in New Jersey that was your principal residence main home on October 1 2018. Income Tax Residents Only Partnerships.

1 real estate tax bills a state treasury official said Wednesday. Pass-Through Business Alternative Income Tax PTEBAIT Sales and Use Tax. Homestead Benefit Online Filing.

Those making over 100000 up to 150000 could get a 25 credit. We do not send Homestead Benefit filing information to homeowners whose New Jersey Gross Income for the application year was more than the income limits established by the State Budget. The program rules and online application are found at njgovtaxation click on Property Tax Relief Programs.

Use the instructions below to help you file your Homestead Benefit application over the telephone or online. If you filed last year and did not. New Jersey Governor Murphy froze the May 1 2020 Homestead Benefit Program payment in the midst of the COVID-19 pandemic and then cut the program by 142 million.

There is no partial year credit if you were not living in the home as of Oct. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes. 9-1-1 System and Emergency Response Fee.

A Texas homeowner may file a late county appraisal district homestead exemption application if they file no later than one year after the date taxes become delinquent. Credit on Property Tax Bill. Just how much property tax relief would people see.

All property tax relief program information provided here is based on current. 2016 2017 2018 Phone Inquiry. And over the past five years the average New Jersey property-tax bill has increased by 563 easily swamping todays average Homestead benefits which are 526 for senior and disabled recipients and 412 for.

If a benefit has been issued the system will tell you the amount of the benefit and the date it was issued. 75000 for homeowners under 65 and not blind or disabled. New Jersey homeowners will not receive Homestead property tax credits on their Nov.

You can file for a Homestead Benefit regardless of your income but if it is more than the amounts above we will deny your application. To file an application by phone1-877-658-2972. Make sure to save it.

Over 100000 But not over 150000. The program was restored in the approved budget that went into effect on October 1 2020. The document you are trying to load requires Adobe Reader 8 or higher.

The typical delinquency date is February 1. The Homestead Benefit program provides property tax relief to eligible homeowners. File Online or by Phone.

Online Inquiry For Benefit Years. The main reasons behind the steep rates are high property values and education costs. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces what you owe in property tax.

The automated telephone filing system and this website will be. You can change all preprinted information with the exception of Name and Property Location when you file online or over the phone. 2018 Homestead Benefit payments should be paid to eligible taxpayers beginning in May 2022.

The typical deadline for filing a county appraisal district homestead exemption application is between January 1 and April 30. You owned and occupied a home in New Jersey that was your principal residence main home on October 1 2018. Search here for information on the status of your homeowner benefit.

Check or Direct Deposit. The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 - was November 30 2021. Multiplying the amount of your 2017 property taxes paid up to 10000 by 5.

And erty should file the application. The 2021 property tax credits are based on ones 2017 income and property taxes paid. And seniors or disabled people werent eligible for any credit if they made more than 150000.

The Homestead Benefit program provides property tax relief to eligible homeowners. To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019. 1-877-658-2972 toll-free within NJ NY PA DE and MD 2018 benefit only.

Property Tax Relief Programs. Allow at least two weeks after the expected delivery date for your county before contacting the Homestead Benefit Hotline at 1-888-238-1233 or visiting a Regional Information Center for help. Homestead Benefit Program.

Property Tax Relief Programs West Amwell Nj

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

Memoli Company Pc Home Facebook

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 4440099

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Video Online Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Video Online Download

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

Property Tax Relief Programs West Amwell Nj

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Video Online Download

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

Nj Property Tax Relief Program Updates Access Wealth

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Video Online Download